My whole life was dedicated to baseball from an early time. People say, "Don't put your identity," or "You're not a baseball player. That's not your identity." It really is though. While it's not, it feels like it, because every decision I made, everything I was passionate about was baseball and achieving the next level.

LISTEN

EPISODE TRANSCRIPT:

Skyler Irvine:

Joining me today is a very, very fun guest for me personally. I’ve known you pretty much your whole life now. John Brontsema, thank you so much for joining me. How are you doing this morning?

John Brontsema:

I’m doing awesome. I’m super excited to be here. I listen to a lot of your podcasts. You’ve had a lot of great people on, so I’m honored to be on.

Skyler Irvine:

You are far too kind. I really appreciate that. There’s a lot of questions I want to ask you about some of your past. I know you’re a young kid, but you’ve accomplished a lot in a small amount of time. You were a college athlete and then a professional athlete and have recently shifted into the corporate world. Before we talk about some of that transitioning and that experience, I’d love to take a moment to talk about what it is you’re doing today and expand from there.

John Brontsema:

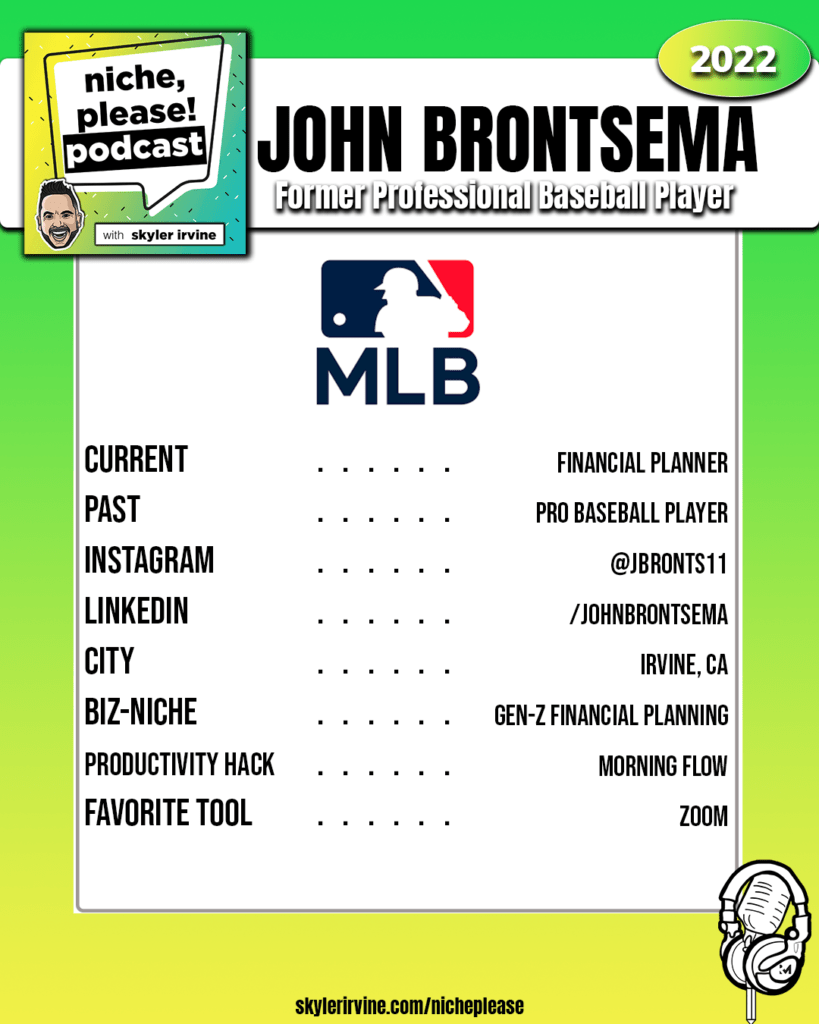

Absolutely. Currently, I’ve made the shift into a financial advisor. I sit down with people on a daily basis. We look at their financial plan. I’m able to identify strengths, weaknesses, make adjustments. It’s not just about the investment side. When people hear financial advisor, oftentimes they think about, hey, this guy’s just going to come and invest for me. It’s more than that. It’s really making an impact on a whole scale where we look at a whole financial plan. This really started for me, ironically, with you and your dad. I always saw you both talking about money, talking about investing, talking about business. So when I got drafted, got this chunk of change from my signing bonus, I didn’t really know what to do with that. I didn’t know much about investing.

John Brontsema:

It was actually your guys’ lead and you both being excited about making money and what you can do to make money, and you guys shared that passion with me. That kind of got me going on that path. I started self-teaching myself about the market and I started investing my money a little bit out of time on my own completely. And then, the passion just took off from there while I was playing. In three to four years while I was playing, I just started investing and investing and learning about the market. And then, when it came time to finish up, it was what do I do next? And this jumped out as something that I’d love to do. You guys impacted me that way.

John Brontsema:

I want to make an impact. I want to jump in, help a family early on in their lives, as they’re setting up their financial plan. They’re busy with their job. They’re busy with their kids. I can help them make all the right decisions that will set them up for a good future. All they have to do is fund it a little bit out of time. So, it’s really cool to be able to make an impact, and help people become wealthy in the long run. It’s just an exciting job for me. It’s one you can make an impact and it’s something that I’m passionate about. It really checks all the boxes as far as making me happy, and then I also get to help a lot of people, so it’s a good gig.

Skyler Irvine:

I’ve done 300 plus episodes of recording podcasts on this show since the start, and I don’t think I’ve ever talked more about my personal family and stuff, so it’s funny that that gets brought up now, because what you say about my dad, it’s an interesting thing of, most families never, ever talk about money, and I went through a whole college life from kindergarten through college and you don’t learn pretty much anything about money.

John Brontsema:

Absolutely.

Skyler Irvine:

The next phase of trying to learn about it when most kids or people don’t have anyone in their lives, that’s even talking about money, mine was almost the opposite of my dad maybe talking about it too much, and not really in a negative way, but more of keeping the mindset of certain things of value of importance and not feeling uncomfortable in situations. To hear that has had an impact on you is really interesting because it’s a shared history we have. Where it stands today for you, who is your ideal client or customer? Who’s the best person, if you’re at an airport and you hit a flight delay and you’re sitting at the bar, who’s the ideal person to sit down next to you and have a conversation with for 20 minutes.

John Brontsema:

Absolutely. That’s a great question. For me, it’s people like me, roughly my age, a couple years older, a couple years younger. This is people early in starting families, just married, just having kids, just buying a house, because early on, if we set things up the right way or get close to setting up things the right way, that’s impactful. I look back at myself and I look back for four years from now and where I started. I am so thankful that I started. In just four years, I look back on the impact my financial planning has done for me. I want to make that impact on a lot of people, so they look back in five years and they say, “Holy smokes. I’m so glad we started and we made the effort to start and set up a plan.” It’s so worth it. It’s so impactful.

John Brontsema:

So, a young person like me starting a family, is where I can really make an impact and help diversify their investments, what type of accounts they [inaudible 00:04:46], help them understand the difference between the Roth and a 401k and all these different things. That’s where I feel like I can make the biggest impact and where, you have your book, Niche Please”, so that’s something early on in my career. I’m trying to really find that niche and there’s so much early on in a career when you get in, it’s like drinking water from fire hose. There’s so much in the financial industry, there’s so much you can do, and I’m really learning every single one of these aspects and figuring out, hey, where do I want to land? And early on, this is my ideal client. I do know that, but as far as that true niche, I’m in the search for that.

John Brontsema:

In your book you talked about, you mentioned how in Lizzy, it almost found her and I’m hoping that’s going to be a mix of me using some of the principles you had in your book to really search it out, and also, hoping it finds in me a little bit a mix between, hey, this aspect of financial planning or that aspect of the financial industry is where I could fall into that niche, but right now I’m kind of testing it out early in my career and waiting for that time for it to find me or for me to find it, and then really just going to attack from there. So, to answer your question, really that young person like me, I can really make an impact where they can look back five years from now and then, not to mention 20 years from now, I’ll be so glad that they had someone guiding them and hopefully they’ll see a ton of success.

Skyler Irvine:

That’s incredibly powerful, and before even moving on, I want to just double down on that because I think a big mistake and not even a mistake, because it’s a lack of knowledge than anything, but a lot of people would wait until they have money before they start thinking about what to do with money, and usually that’s the person that makes the big mistakes with money, waiting until you have it, waiting until you’re 50 or 60 to talk to a financial advisor, because you’ll find out all of the things you’ve done that put yourself in a worse position than a better position. I’m living proof of it as someone who graduated into the last great financial crisis and made certain types of decisions with my efforts and money that made it when this recent recession hit, which turned out to be brief, but I didn’t know that I was able to kind of live off of the momentum of all the things I did in my early twenties, because I don’t have as much time.

Skyler Irvine:

When you’re 20, you think, okay, I’ve got a lot of time to make this money, but you only have so much time in the day. And once you start having kids, once you start having a life, once you start having a career, you have less time in the day. So it’s harder to make up for lost time as you get older and someone hearing I’m in my early twenties, I have my first job. All I did was sign up for the company provided IRA. I’m set. I think the counterpoint to that is, now is literally the best time to start having that conversation with someone, build that rapport, because if you’ve got certain goals, having someone on your side that can help you achieve those goals is incredible.

Skyler Irvine:

I think you talking about your niche, a lot of times you’re still in the age of trying everything to find out what you don’t want to do and you start just cutting those out, cutting those out, and finding the things that you do. Sometimes the market helps you sometimes just your natural, the career path helps you. I think that type of niche is really, really fascinating because it’s hard to imagine what it was like 20 years ago to get financial information. It was really expensive books or I had books on tape that I’d spend $60 on and get nine different CDs that I’d have to switch through on a car ride, and now we’ve got podcasts and YouTube channels and younger financial advisors that have experienced certain things that you could communicate with and we’ve never really seen a time like today.

John Brontsema:

No, I couldn’t agree more, and people don’t realize the power of starting early. When I was about 18, my mom made me start a Roth IRA, and fund it at $100 a month. No clue what it was, didn’t want to do it. She told me it was for retirement. I’m like, why would I ever do this? I look at it now. I’m so glad I did, and I want people to have that same feeling and to really understand that starting young will make the biggest impact. Even if we’re funding things at a super low monthly rate, you will find a point in your life, when it is it maybe in your thirties, forties, fifties, where then that’s when you can really fund these things, but starting early and using compound interest, super impactful, and I want to help people make some of the decisions I was able to make due to motivation from you and your dad and that’s where I’m at with things.

Skyler Irvine:

That’s cool. I honestly think that the habit of learning to save $100 a month is so much more valuable and crucial and important than what you actually do with that $100 a month, whether it’s an IRA or just a savings account that earns zero interest. The habit of putting that little bit of money away all the time, is the most important thing to build wealth long term, in my opinion. Let’s jump backwards. Let’s go back in time. I want to talk a little bit about, you’re a baseball player. You’ve played baseball your whole life. I’ve always known you as a baseball player. What is one or two things that most people would have no idea about being a collegiate athlete? What do most people get wrong or be surprised to learn about what it’s like being essentially, a full-time collegiate athlete with ambitions of going pro?

John Brontsema:

That’s a great question. Well, when people think of a collegiate athlete, oftentimes, they think of an Alabama football player, a guy who might get away with things and they’re not putting as much time in schoolwork, whatever, but the majority of student athletes across the country really are also full-time students and they have that expectation. They have to get the grades. The mix between a full-time athlete and a full-time student, it’s a big time task. Going to all your classes, having your coaches monitor that and doing everything, having to upkeep really good grades, that’s no joke, and it definitely takes a strong effort. It’s like someone who is an athlete who has to work a couple jobs. It’s overwhelming. You have to make decisions. For me, every decision I made starting back in high school was because I knew I wanted to play professional baseball.

John Brontsema:

Every decision I made, had that in mind. My decision to go out and party or not, my decision to go to class or not, to go to extra weights. Whatever it was, the discipline you have to have to be successful in college… The people who are freak athletes and can do it with little effort are few and far between. Majority of the people you see succeed at the college level are really putting in the work, the extra work, the stuff that you don’t see. I really appreciate college athletes, professional athletes, because people say, “Oh, they’re getting paid all this money for a game at the professional level,” but your whole life is dedicated to that. My whole life was dedicated to baseball from an early time. People say, “Don’t put your identity,” or “You’re not a baseball player. That’s not your identity.” It really is though. While it’s not, it feels like it, because every decision I made, everything I was passionate about was baseball and achieving the next level.

John Brontsema:

I have no regrets in my career. The one maybe regret I have is that I didn’t enjoy the success because when I had success, it felt like that’s what I had to do, and when I had down times, that was frustrating and I got down on myself, and then when I come back on success, I didn’t feel like I didn’t enjoy it enough because it felt like, this is what I’m supposed to do. Why would I be happy? I think a lot of people have to have that mentality to get to that level. College athletes, and especially ones that are succeeding in the classroom, it’s an impressive feat.

Skyler Irvine:

Yeah, I can’t imagine what it’s like to have such a clear goal at such a young age to work towards for so long and have it be so clear cut. I don’t think I’ve ever had that, and everything for me was about getting into college. When I was a month away from graduating college, all of a sudden, everyone I knew was going up for job interviews and stuff and I felt so caught off guard thinking, wait, what? I never even considered the next step, the next thing. It was almost like I was blindsided from something that was obviously around the corner, but for whatever reason, I was unprepared for it. What was that like as a college athlete, so focused on getting to the next level and finally getting a call from that baseball team and letting you know that you’ve been drafted to the next level, to a professional team? What is that experience like actually getting drafted and chosen and picked?

John Brontsema:

Yeah, that’s an incredible experience. Nothing can really top that, up there with one of the better moments in my life. Just because there is this, like you said, there’s this wait, there’s this expectation, and to finally get there is so awesome. The moment for me was talking to multitude of teams and they’re calling and calling, and so day one of the draft is kind of where I expected to go. Didn’t go on that day. It was a bummer. Then the next day, I had teams calling me, calling me, calling me early on. And then, I finally got a call from the Kansas City Royals saying, “We want to take you, and here’s the offer for the signing bonus. Would you accept?” It was where I wanted to be, so I said, “Yes, let’s do it.” Just a huge relief. I was able to call all the other teams I was speaking with, say, “I have a deal in place. I appreciate you,” and all this stuff, and then waited for my name to be called. It was just a great experience.

John Brontsema:

Everything in professional baseball was exactly what you would want and more. People talk about the minor leagues. They think about 15 hour bus rides in the middle of the night, terrible food, low pay. It was all of that. Terrible conditions, living conditions, losing money, spending more money on rent than you make, all true, but it was beyond worth it. I’d do it again. I’d do it again right now. It was just a great experience for the chance to reach where you wanted to go, but that whole transition, even through high school, to the getting the college offer, and then just every next step, every level you get called up in the minor leagues, it’s that same thing. That’s one of the few times where you can feel some accomplishment and you really felt good about yourself. Definitely a great experience.

Skyler Irvine:

Going back a little bit to that, the minor leagues experience, a question that I’m personally curious in is, it is a really tough and rough life being in the minor leagues, do you stay in contact with anyone that’s been going through it the last couple years, dealing with a whole new level of COVID era restrictions and lockdowns and restarts, and what that’s been like for this last three years?

John Brontsema:

Yeah, absolutely. I do, I still have tons of friends in the minor leagues. I actually have a ton in the major leagues. I know about 30 people pretty well that are in the major leagues, but as far as the minor leagues, it’s been a grind for them. It’s been tough. Their whole season got canceled in 2020 and then they’ve been battling different spring training regimens, different training regimens, COVID protocol. It’s been tough, but the one thing I think about the minor leagues and having that youth and the reason everyone’s still so underpaid and the rights are not good is because you’re young and you want to make the major leagues, and that’s what you’ve wanted for a long time, so you just put up with it. I think that’s almost an advantage that major league baseball has is that, these guys, everyone’s pretty much willing to put up with it.

John Brontsema:

And if you’re not, it affects your play and then you’re gone. That’s why they can get away with what they get away with, just because it almost seems like, okay, this is what I have to do. What’s next? How can I… This is what I have to do. You just adapt and roll or else you’re out. That just comes down to it. Guys are getting cut left and right and less than 10% of people that get drafted even get one day in the major leagues. So you have to really fight and claw to get there. You can’t let other things bog you down or else you’re just not going to make it.

Skyler Irvine:

What happens in your baseball career? When do you start thinking about what’s next? Do you give yourself a deadline? Say if I’m not at this point at here, I’m, I’m going to move on. I know you’ve dealt with injuries, which is just brutal to have to deal with, especially with the back and at some point choosing health and your next 60 years versus risking it for the next six months, has it maintained that same type of, I don’t know, mental anguish, has it gotten easier? Has it gotten tougher? What was that journey like for you?

John Brontsema:

Yeah, that’s such a good question, because this is such a good point. First of all, you and I had the same back surgery. So, you and I have experienced the pain that comes beforehand and the grind afterwards. My career went really well, better than I could have expected. I performed better in pro ball than I did in college. I got better and was continuing to get better. I was in Double A, reinjured my back for the third time, and finally had to do the surgery. That day that I realized that I had to go back to the Arizona complex, the spring training complex from Double A, when they sent me back to officially go back and do rehab and/or potentially surgery, is the day I knew that my career is in jeopardy. Called my dad and I told him, [inaudible 00:18:10], I said, “This could have been the last day I step foot on a baseball field,” and went to Arizona, tried to rehab it a little bit.

John Brontsema:

They realized after an MRI, it’s just too big at this point, not to operate. Operated. Seven straight months, every single day of rehab, got to a point where I was healthy again. Strong. Came into spring training and performed well. I had one more season under my belt, ended up breaking my thumb in half at the end of that season, and eventually got released because… Really not because of how I performed. My career batting average was over 300 professionally. I could play a lot of positions. I could do a lot of things, but there’s an 18 year old Dominican kid or young draftee who is potentially just as good as you, so you’re not-

Skyler Irvine:

And doesn’t have a broken thumb or a history of the back.

John Brontsema:

Right.

John Brontsema:

That’s what really ended my career. And then from that point, I could have kept playing. There could have been a spot. I had things lined up, but like you said, what was the decision and the factor and that factor was, I’m getting engaged. I want to set up my family, and like you said, early on in my career, I looked at… I said, “If in four years I don’t have an easy path to the major leagues, I’m going to consider retirement.” After that fourth year, I looked at it, my path wasn’t easy. Could I still be playing right now? Yes. Could I be closer to the major leagues? Yes. Could I be cut? Yes. But at that point, it was take my health, start a new career, actually make money and let’s set my family up.

John Brontsema:

I’m passionate about what I do now, but it definitely doesn’t take away from the pain that I feel. Burying your head in your life is the only way to kind of get past it and let time heal it, but I miss it every single day. I wish I was still playing. I feel like I could still be playing, but at some point, you have to make that decision, is my path to the major leagues easy? And it wasn’t easy anymore. I kind of took my health and run, like you said. I think a lot of people throw them so into a job for a long time or throw themselves into a passion for a long time, and then it reaches an end point, boom, where it’s done, whether it’s because of an injury or whatever it might be, and that’s definitely a tough thing to get past, and I think time’s the only thing that will heal that. You really throw yourself into it, so you’ll miss it every single day.

Skyler Irvine:

There’s a great story because it affects all of the countless college athletes and professional athletes that have to make that choice, and I also think it affects an entire generation of people going through the COVID pivot, whatever we want to call it, but with record number of people deciding to leave their jobs and making a choice to do what’s next, and understanding that life’s a lot shorter than they thought, or time flies and we talk about setting yourself up for success in 25. The thing is, you’re going to blink, you’re going to be 35, and then you’re going to blink, you’re going to 45. That time’s going to go by regardless.

Skyler Irvine:

A lot of people, you just get stuck on the path that you were on. A friend gets you a job. You end up working at that job. You get promoted enough to stay and 15 years goes by and you’re working at a company and a job you don’t love, a career you don’t love, and I think there’s a lot of people right now that are still on the fence about making that call, walking away on top or walking away on their own terms like you did, and it’s cool to hear, the why is what carried you, knowing what you wanted to do and how you wanted to achieve it, and having a family that you wanted to take care of, is there a better thing that you could be doing to achieve that goal? Because as you get older where you are at 15, your goal is to play sports as long as you possibly can. 25 and a fiance, and the idea of settling down somewhere, playing baseball for another 10 years might not coincide that well with that new goal.

Skyler Irvine:

So, reevaluating what you’re doing and what your new goals are and making decisions based on that is definitely easier said than done, so talking to you firsthand as someone who’s just did it and did it in a very difficult way, because you’re still giving up something you love so much, I think’s going to help a lot of people, so I appreciate you sharing that with me. Is there anything you’ve learned about yourself, personally or professionally, from this journey? Anything that surprised you about, about yourself?

John Brontsema:

I really think resilience and confidence, I never realized how much confidence played a role in success or performance. When I was confident and I felt confident in my abilities or where I was at, I succeeded. When I lacked that confidence, my performance slipped. Overall, I feel like I’m a very confident person. I’m confident in myself, I’m confident in my abilities, but there are times when without your confidence, you’re not going to perform, no matter where we’re at, whether it’s sports or the corporate world. If you’re not confident in what you’re doing, you’re not going to perform, so really learning and understanding that. I also just understood that the professional sports is a grind. There’s extremely high competition. It takes a lot out of you, and I loved every second. I didn’t mind any part of that lifestyle. So, just being resilient and working through injuries, coming back, battling, getting back, having success, it just taught me, if I have confidence in myself, there’s not anything that should stop me, and just having that mentality and learning that, has been very helpful.

John Brontsema:

The weird thing about professional sports is, a lot of these guys that are having success, like Patrick Mahomes is one of the greatest already quarterbacks of all time. What is he, 26, 27? He’s my age, right? That’s incredible. This dude’s been doing it from a young age. Most people are getting better, getting better, putting everything they [inaudible 00:23:56] and then, 24, 25 years old, everything’s ripped from them. Not everyone is Patrick Mahomes, and just dealing with those ups and downs, really prepares you for a lot of ups and downs that you’ll deal with. I’m thankful for sports. It gave me so much, taught me so much, wouldn’t trade my experience for the world. I have no regrets and I think it really has set me up in a position to be in this real world now where I can carry those lessons with me. That sounds cliche, but it really is true. The things that baseball taught me in my road, in baseball, the injuries that I dealt with, the successes I had, and the failures I had, have really set me up to, I think, handle things in the real world.

Skyler Irvine:

Do you have any predictions or thoughts on the future of work and the workplace based on your own experience and conversations you’ve had with friends and acquaintances of a similar age? This COVID pandemic is entering calendar year three. It doesn’t look like it’s ending anytime soon. The thing is, even though we’re all going through it, we’re all going through it so differently. I’ve got three young kids and have had to pivot from homeschool to Zoom school, to back to school, versus a friend of mine who’s living in California in a small apartment by himself with a lot of alone time. I’d love to get your opinion, as someone who’s going through it in a very different experience than mine, what do people like and don’t like about remote work and what are your predictions of where the future of work might be?

John Brontsema:

I can really speak for my generation. A lot of my friends are really coming out of the nine to five desk job. It’s not something they’re willing to put up with anymore. For example, I don’t think I could ever do that. Maybe I’ll be in a position one day where I can, but I’m independent, so I have freedom. I can work as much as I want, or as little as I want, and I’ll yield those results, same as baseball. I like being in that position. I like controlling what I do. I don’t want to have to ask for vacation time, and I think a lot of people are realizing that, that there are a lot of remote jobs or different types of work that will provide that flexibility at our age and people are now realizing that, and I think they’re wanting to get out of the nine to five, three days a year vacation time, into a spot where maybe they’re owning their own business or they’re part of a business where there’s more flexibility or whatever that might be.

John Brontsema:

And people think that’s the lazy way out, but it’s really not, because when you’re on your own business or you’re on your own hours, it’s up to you. If you’re not putting in the work, you’re not going to see money. You’re not going to see results. You’re not going to have that job. It puts more pressure on you, but I think people are willing to take on that pressure or that stress to have a little bit more flexibility. That’s what I’ve noticed in people in at least my generation are starting to realize.

Skyler Irvine:

We’ll get out of here pretty soon. I want to end with a couple specific, rapid fire questions and learn about some tools and hacks. What’s your favorite productivity hack and how did you discover this?

John Brontsema:

That’s a good question. I think early morning work for me has always been something that has helped me be productive. I don’t know why I’m more motivated in the morning. I feel good in the morning, so when I get on a roll, I want to take advantage of that and keep going and keep going and keep going. There are days as an independent contractor where you just don’t feel it. Really taking advantage of the days where you do and then really getting after it has helped me early in my career have some success as a financial advisor.

Skyler Irvine:

It’s a great answer. I like the, there are times where you’re just so in that flow, being able to capitalize on that and take advantage of it to, not essentially make up for the days where you don’t feel that, but it gives you a clear path of knowing that some days you don’t feel it and you shouldn’t feel that down on yourself as long as you know, you’re capitalizing on the days that you do. I think that’s really cool. What’s an underrated tool that you find indispensable to your job today? It could be an app, could be an idea, a concept, anything that comes to mind.

John Brontsema:

That’s a good question. Nothing particularly yet, for me. I’m in the higher education mode, so I’m continuing to get licenses, continuing to learn more. For me, the access that I have and the ease I have to information is my best tool right now, because I’m soaking up and continuing to learn and continuing to get better, so I can help other people. My best tool is the readily available information, all the licenses I have to be able to obtain that will help me gain knowledge and be able to help my clients. Like you mentioned before, back in the day, this information wasn’t so readily available. I’m lucky to grow up in an era where it is. Actually speaking on that, I think Zoom and the ability to teleconference has been massive in my world. I’ve come up my whole time here as a financial advisor has been 85% Zoom calls. Advisors in the past are driving different places throughout the community. I’m able to work with people in Nevada, Arizona, California, Northern California, whatever it is, because of Zoom. So, that’s been a huge tool for me to be able to use and abuse because I can work with anyone at any time. That’s been a big tool for us in our industry.

Skyler Irvine:

Yeah, that’s very unique, and I like getting your insight on that as someone, you came up with Zoom. People my generation and older, don’t like it compared to face to face meetings, but going from nothing to Zoom and then to transition to old school business travel seems absurd, and your generation moving forward of the comfort and ease of use with Zoom, it’s almost all you know in business, which makes you adapt so much quicker and seeing how that carries forward is going to be really interesting.

John Brontsema:

How the industry, if it’s going to stay with teleconferencing or if it’ll end up going back to out of face to face, I’m sure it’ll be a mixture of both.

Skyler Irvine:

Take sports out of the equation and fast forward several years, what’s one occupation other than your own that you’d like to try someday, or maybe in a different world or different life?

John Brontsema:

Yeah, very good question. I think actually a sports physical therapist. I had some people that took care of me in my rehab that really impacted me and my health. I would’ve loved to have taken that route and be able to impact people that are dealing with sports injuries or injuries like you and I had. Having a good therapist and getting you back and getting you right is another thing that I would’ve loved to have done and still probably would love to do.

Skyler Irvine:

Yeah, there’s no relationship like the one you have with a physical therapist who cares.

John Brontsema:

Yeah!

Skyler Irvine:

When you’re in a lot of pain for so long, no one wants to hear about it, and when there’s someone in your life that’s actively trying to help you feel better. It’s a very, very deep, special relationship is created.

Skyler Irvine:

I know you’re in the middle of a lot of licensing, but are there two to three books that you’ve read recently that have helped you either in business or personal life that you’d recommend to my audience and why those books?

John Brontsema:

Well, honestly, obviously, starting out with your book. It’s really impactful.

Skyler Irvine:

You’re like a paid sponsor at this point. I appreciate it!

John Brontsema:

It’s an easy read. You can knock it out, but it also has depth to it, so it’s like the perfect mix of big, quick and easy, and keeping that short attention span interested, and having length and depth to it. It’s super impactful. I enjoyed it. Cheesy or not, Tony Robbins, one of his books I read recently. It’s really just about basic fundamentals of finance, and it’s a motivating book, what successful people did. It just keeps me motivated and me understanding that, hey, I’m doing the right thing. I’m going to be able to impact people and sometimes you need to read a book like that, where the lessons might be simple, but you are more motivated and it keeps you being able to pass that motivation on and that confidence onto other people.

Skyler Irvine:

Do you know the name of the book? Was it his money book or is it one of his… I know he has a new one that came out in the last few years.

John Brontsema:

It was, Money Master the Game.

Skyler Irvine:

What is one question that you wish that I would’ve asked you and how would you have answered it?

John Brontsema:

There isn’t one. I think we covered everything that is significant. I enjoyed it a lot.

Skyler Irvine:

Awesome. Where’s the best place for people to connect with you and, and learn more about you? Website, social media, email, what do you prefer?

John Brontsema:

LinkedIn is the easy way to do it, and Instagram is more of a personal thing for me, but always willing to connect there. If you have any questions, tax implications, what type of accounts do I open? What do I invest in? Anything like that, of that nature, any questions surrounding finance, I’m happy to help and guide people in any way I can.

Skyler Irvine:

Literally, there’s no dumb questions when it comes to this stuff.

John Brontsema:

Absolutely.

Skyler Irvine:

A lot of people are starting from scratch, so I think you’d be a great first contact to get some of those questions answered. John, thanks so much for joining me and taking time out of your work day. I appreciate it. Give my best to your family and thanks again, man. I really appreciate your time.

John Brontsema:

What a blast, man. That was awesome. Say hi to Lindsay and the kids. I love your kids. They’re the cutest things on earth.